Wells Fargo Careers – Wells Fargo & Company has been an outstanding player in America’s history of finance since 1852. Today, Wells Fargo provides diverse financial services for consumers, small-scale enterprises, farmers and ranchers, medium-sized and large-sized enterprises, immobilizers, and local governments in more than 36 countries and territories.

Wells Fargo Careers

Wells Fargo is an American multinational financial services company headquartered in California, U.S.A.

Wells Fargo was the largest market capitalized bank globally in July 2015, surpassing ICBC before slumping behind JPMorgan Chase in September 2016. In addition, Wells Fargo was the third-largest bank deposit behind Bank of America in 2017 and the fourth largest in 2018 behind Citigroup.

Wells Fargo provides various banking services that enable a single financial institution to meet all of your banking needs. In addition, Wells Fargo may call on individuals and corporate owners who want access to branch banking through the convenience of online banking.

Job Opportunity:

Wells Fargo appreciates and promotes the diversity and inclusion of businesses and organizations at all levels.

They select applicants based on their personal skills and experience, in line with the law. Therefore you should not be concerned about discrimination based on race, color, sex, nationality, religion, age, sexual orientation, gender expression, physical or mental handicap, marital status, or other status protected by federal, state, or local law when you are seeking a job in Wells Fargo.

Wells Fargo is mainly a cash management entity, working directly with clients and business equipment to deliver sound financial services, checking and savings accounts, and lending services. In addition to the consistent use of computers to enter data and monitor market trends, many of the jobs with the financial firm provide regular human interaction. Work environments also involve many works at desks, although customer service tasks usually include regular customer conversations.

Wells Fargo applicants must exhibit credible and confident personality characteristics due to the nature of the industry. In some respects, most positions have the responsibility to do with the handling of thousands of dollars every day. The financial firm carries out background checks to ensure that employees are qualified for existing jobs and conducts drug screening and multiple interviews rounds before official hiring. Jobs such as bank accountants and customer service representatives normally require employees to pass basic job checkups to be honestly taken into account for positions at the time of arrival. Often advanced education and background in the financial service sector require high-level opportunities in management and careers in business home offices.

Career Paths at Wells Fargo:

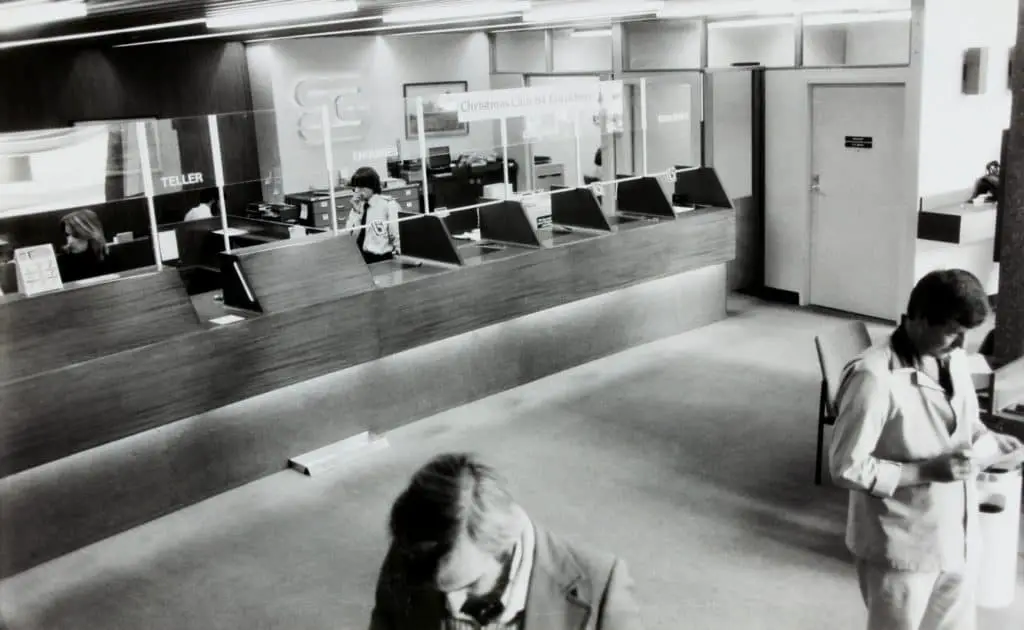

- Bank Teller:

- At Wells Fargo, the primary responsibility of a bank teller is to process deposits and withdrawal requests of consumers. Wells Fargo’s bank teller principal duties are:

- Greet and thank customers for their work.

- Deposit and withdrawal requests accepted and completed.

- The identification policies of the company are always followed.

- Providing customers with different financial products.

- Telephone response

- Representative for Customer Service

- Salary:

- The wages for this job vary from $9.00 an hour to $16.00 an hour.

- Bank tellers at Wells Fargo should be very professional; they should follow its dress code and always act professionally. Also, when clients come to the counter, you should try to connect with them.

- At Wells Fargo, the primary responsibility of a bank teller is to process deposits and withdrawal requests of consumers. Wells Fargo’s bank teller principal duties are:

- Data Entry Clerk: A typical day of work for a data entry clerk at Wells Fargo would be checking loan applications, verifying loan numbers, and ensuring that loan documents satisfy certain criteria. In addition, an employee learns how the credit documents are processed for examination.

- Salary: Wells Fargo’s Data Entry Clerk’s average salary is 17 dollars an hour.

- Salary: Wells Fargo’s Data Entry Clerk’s average salary is 17 dollars an hour.

- Administrative Assistant: The management and distribution of information within an office are the major responsibilities of administrative assistants at Wells Fargo. Their duties generally include replies to telephones, recordings, and file maintenance. Administrative helpers can also send and receive letters to clients and customers, as well as greetings. In addition, they can work on projects or assignments with other team members that allow them to learn and appreciate other cultures.

- Salary: The average salary for an administrative assistant is $41,044 annually.

- Salary: The average salary for an administrative assistant is $41,044 annually.

- Personal Banker: Wells Fargo’s personal bankers focus on developing long-term connections with consumers and small firms. Successful bankers show real customer interest and questions about how Wells Fargo can help their financial needs understand them. Personal bankers develop strong relations with other Wells Fargo partners that allow customers to be introduced to specialists who can help with specific financial needs. Personal bankers can offer customers options for easy and convenient operation while ensuring that the customer’s requirements always come first.

- Salary: The salary ranges from 29,000 dollars per year to 43,000 dollars per annum.

- Salary: The salary ranges from 29,000 dollars per year to 43,000 dollars per annum.

- Loan Officer: In Wells Fargo, loan officers examine the applicants’ financial status, loan, and real estate assessments to determine their feasibility. It is the loan officer’s duty to monitor the loan process.

- The most important tasks of creditors are:

- Assessment of loan dignity through the treatment within specified limits of loan applications and documents.

- Interview applicants on the financial eligibility and feasibility of lending.

- Fixation and set up debt payment plans for all applicable ratios and metrics.

- Salary: The salary for this job varies from $15,000 annually to $37,000 annually.

- The most important tasks of creditors are:

- Accountant: Accountant entry levels at Wells Fargo are responsible for ensuring the company’s financial documents through the analysis of balances and general accounts and the preparation of reports.

- An accountant’s job includes:

- They carry out extensive research is carried out in the context of departmental policies and procedures to solve routine to complex client requests as needed;

- Transactions to include data entry in related systems.

- Review and determine appropriate measures of incoming inquiries.

- Salary: The accountant’s average salary is 61,121 dollars annually. You must be able to work long hours and look closely at details to succeed as an accountant.

- An accountant’s job includes:

- Sales Associate: The Wells Fargo sales associate assists with deposit and savings accounts, provide advice to clients on the provision of banking products and services, sells to potential and existing clients to generate new business, and develops tailored plans to help clients achieve their financial goals.

- Salary: The average sales partner of Wells Fargo earns $47,000 per year, including an underlying salary of €45,000 and a bonus of $2,000.

- Salary: The average sales partner of Wells Fargo earns $47,000 per year, including an underlying salary of €45,000 and a bonus of $2,000.

- Financial Advisor: A Wells Fargo’s financial consultants are responsible for day-to-day account management and the provision of customers’ investment counsel, investment management, and wealth management services. They work with customers to determine their objectives and risk tolerance, implement the plan, review their progress and change it over time as their lives and objectives change.

- Salary: The annual pay of approximately $71,898 by averaging Wells Fargo Financial Advisor.

- Salary: The annual pay of approximately $71,898 by averaging Wells Fargo Financial Advisor.

- Financial Planner: The job of Wells Fargo Financial Advisors is to help customers accomplish their life needs and financial goals monetarily by planning their investments.

- Salary: The average annual salary is $67,848 for a financial planner.

- Salary: The average annual salary is $67,848 for a financial planner.

- Risk Analyst: Wells Fargo risk analysts examine the investment portfolios of an enterprise and analyze risk in associated decision-making, including overseas investments. It uses its analytical skills to project potential losses and recommends limiting risk through diversification, exchange in currency, and other investment policies. They decide how much risk an insurance company is at or how little to offer a policy to an individual, family, or business.

- Salary: The risk analyst’s average wage is $73,702 annually.

- Salary: The risk analyst’s average wage is $73,702 annually.

- Human Resources Generalist: The HR generalist at Wells Fargo handles the everyday operations of the HR Office and managed policy, procedures, and programs for human resources. Employee relations, training, and development, benefits, rewarding, organizational development, and employment are typically handled by HR departments.

- The work of an HR Generalist consists of:

- Logistics recruitment and personnel

- Planning of space and organizational activities

- Systems for performance control and improvement

- Development of the organization

- Compliance with and reporting regulations

- Guidance, development and training of employees

- Documentation and policy development

- Management of employee relations.

- Facilitation of the Committee

- Communications between company and employee

- Administration of compensation and benefit

- Salary: The average Wells Fargo Generalist for Human Resources is estimated at $143,206 per year and includes an estimated base wage of $126,327 with a bonus of $16,879.

- The work of an HR Generalist consists of:

- Project Manager: Wells Fargo Project Managers play a leading role in project planning, execution, supervising, control and closing. They are responsible for the whole project scope, the project team and resources, the project budget, and the project success or failure. It is their job to develop various projects and ideas to help employees improve themselves and their customer support. Resolve any project problems, identify potential risks or delays and mitigate them.

- Salary: A Project Manager has an average salary of $87,903 annually.

- Salary: A Project Manager has an average salary of $87,903 annually.

- Branch Manager: Wells Fargo manages the branch team to ensure an exceptional experience for customers and team members, manage risk, and support growth. As leaders, your team of direct and indirect reports will be coached, motivated, and developed to reach their full potential and business targets.

- Salary: The salary ranges from $38,000 annually to $65,000 per annum.

Requirements:

This world-class financial supplier is renowned for delivering excellent services. In general, its employees are highly experienced, trained, and qualified. However, sales managers are only making the most of the cut and joining the Wells Fargo family. Wells Fargo looks for leaders, team players, and experts who show passion. The company concentrates on people who are passionate about services and who can develop strong relationships with customers and colleagues. Use this guide to open your interview with a world-class company and start working.

Age:

Wells Fargo hires applicants of the minimum age of 18 years.

Application Process:

The very first step is the application process online at www.wellsfargo.com/about/careers on the company’s professional portal. Next, you may search for jobs on the “Search a job” website at www.employment.wellsfargo.com. Positions can be searched based on ID, location, or keywords. All matching positions are displayed once you have chosen your criteria. To read the full description and requirements, click on your job position.

You will be required to create an account on the website to continue filling in your application form by clicking on the “apply” button to apply for a position. You will be asked to answer questions about pre-employment after creating the account, such as 18 or older? Are you going to make a background review? And so forth.

You must upload your curriculum vitae. Then, you’ll go to another section called “My profile” once you select an option. You will then answer questions about whether you want to start working full-time or part-time, etc. You must also enter your minimum salary at the last two places you had worked.

The subsequent section will require information on your background and work experience. Further information such as degrees, licenses, additional training, etc., can also be provided. The final sections need to know whether you are an official of the government and have been working at Wells Fargo before.

You can check your application form and make corrections if necessary once the application form is finalized, and then send your application form to the recruiting specialist for formal evaluation. In addition, you can track the status of your application through your profile on the application portal.

If you are chosen, you will be invited for an interview, and if you succeed with the interview, you will receive the job offer, and you will be officially welcomed to Well Fargo if you accept the offer.

Benefits:

Wells Fargo offers great opportunities to gain competitive wages and valuable experience in the industry. In addition to experiences and profitable pay, employees benefit from paid training and career development opportunities. Payout time off, retirement schemes, profit-sharing plans, wellness programs, tuition, and scholarly opportunities, travel services, and in-house discounts include the employee benefits scheme for qualified persons. The availability and eligibility of the employment benefits packages may vary according to the position and location of the branch.

The above is a complete guide about careers in Wells Fargo. However, do make sure to read it over if you come across a section that isn’t clear at first look since it is designed to guide you through all the phases of job application at Wells Fargo.