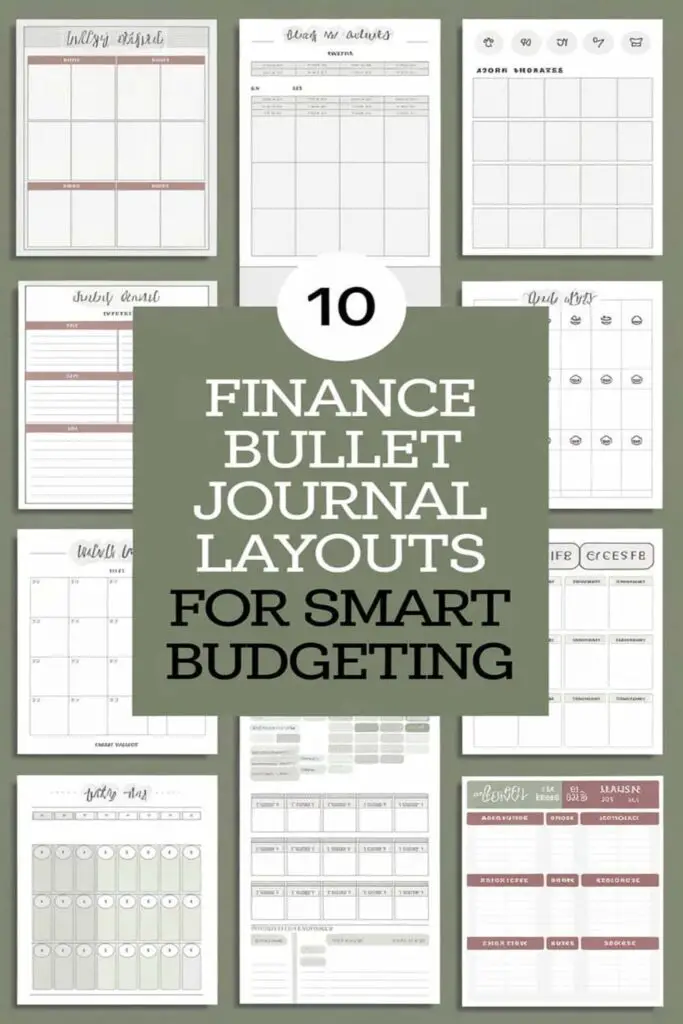

Budgeting doesn’t have to feel like a chore. For me, turning it into something creative and visual made all the difference, and that’s where finance bullet journals come in. They’re not just practical—they’re fun, customizable, and a great way to stay on top of your money without feeling overwhelmed.

I’ve found that the right layouts can completely transform how you track your finances. Whether it’s keeping tabs on expenses, saving for a big goal, or just understanding where your money goes, a well-designed bullet journal can make it all click. And the best part? You can tailor it to fit your style and needs.

If you’re ready to take control of your budget while flexing your creative side, I’ve got some layout ideas you’ll love. These designs are simple, effective, and perfect for getting your finances in check—without losing your sanity! Let’s dive in.

Expense Tracker Layouts

Expense trackers are a great way to monitor where your money goes. With the right layout, it can be straightforward and visually appealing to spot spending patterns.

Simple Monthly Expense Tracker

I keep this one plain and easy to follow. I create a table with columns for the date, category (like groceries or utilities), and amount spent. Each row represents a single transaction. At the bottom of the table, I add a total to see how much I’ve spent by the end of the month. It’s perfect if you want a no-fuss way to track spending.

Color-Coded Expense Tracker

I love using colors to organize my expenses—it’s both practical and fun. For this layout, I assign a different color to each spending category (like green for food, blue for bills, and red for entertainment). Then, I highlight each transaction in the matching color. Over time, I can quickly glance at the tracker and spot which categories are eating up most of my budget.

Income Tracker Layouts

Tracking income is just as important as tracking expenses. With the right layouts, it’s easy to see exactly where your money’s coming from and plan ahead.

Weekly Income Tracker

I like to use a weekly income tracker to stay on top of my earnings each week. This layout works great for anyone with multiple income streams, like freelance jobs or side hustles. I usually create a simple table with columns for the date, source of income, and the amount received. Having a weekly format helps me identify patterns, like which weeks tend to bring in less money, so I can adjust my budget accordingly.

Variable Income Tracker

When my income isn’t consistent, I rely on a variable income tracker to keep things clear. This layout is perfect for freelancers, gig workers, or anyone in sales. I design a chart where I log projected income versus actual income for each month. It’s a great tool for managing expectations and making financial adjustments when the numbers don’t match up.

Budget Planner Layouts

A good budget planner layout can make managing finances so much easier. Whether you’re keeping things simple or getting detailed, these designs help you stay on top of your money goals.

Monthly Budget Spread

I love how simple and effective a Monthly Budget Spread can be. It’s perfect for getting a big-picture view of your finances. I create two main sections: one for income and one for expenses. In the income section, I list all my expected earnings for the month, and in the expense section, I break down fixed costs like rent and variable costs like groceries.

Adding a “leftover balance” section at the end is a game-changer. It lets me see what’s left for savings or extra spending. To stay organized, I also use highlighters to separate needs from wants.

Zero-Based Budget Layout

A Zero-Based Budget Layout has been one of my favorite ways to plan every dollar. Here, I assign a purpose to every cent of my income, whether it’s bills, savings, or fun money. I start by writing my total income at the top, then list each expense category with its planned amount.

At the bottom, I always check to ensure my income minus expenses equals zero. This layout keeps me accountable since I have to justify all my spending. To make it visually appealing, I use bold headers and draw thin dividers between sections.

Savings Tracker Layouts

Tracking savings doesn’t have to be boring. With the right layouts, I can stay motivated and see my progress at a glance.

Savings Goal Tracker

I use a Savings Goal Tracker to visualize my progress toward specific goals, like a vacation or a new gadget. My favorite design is the thermometer layout, where I fill in the “temperature” as I save more money. Another fun option is a grid or bar chart with increments linked to dollar amounts. Having these visuals keeps me excited to save and helps me stay consistent with my contributions.

Emergency Fund Tracker

For my emergency fund, I need a layout that shows a clear roadmap to my savings target. I like to create a page that’s divided into sections—each one representing a portion of my goal, like 10% or $500 increments. Another idea is a tracker that mimics a rainy-day theme, where I color in raindrops or umbrellas as I save. It’s a simple way to track progress while reminding myself how important it is to have money for unexpected situations.

Debt Payoff Layouts

Paying off debt can feel overwhelming, but using the right bullet journal layouts helps me stay motivated and track my progress. Here are two layouts that make tackling debt simple and rewarding!

Debt Snowball Tracker

I like this layout because it focuses on quick wins. I list all my debts from smallest to largest, including the creditor, total owed, and minimum payment. Then, I create a series of progress bars next to each debt where I shade them in as I pay down the balances. This visual element keeps me motivated to knock out smaller debts first while rolling payments into larger ones. Adding a “celebration box” after each payoff milestone makes it even more fun!

Debt Avalanche Tracker

For this, I prioritize high-interest debts. I organize debts by interest rates from highest to lowest, including their balances and minimum payments. Next, I use a stacked chart to track payments, where each section represents progress toward paying off one debt at a time. I really appreciate this layout because it saves me money in the long run by targeting high-interest amounts first. Adding notes about interest saved motivates me to stick with the plan.

Conclusion

Using a finance bullet journal can completely change the way you approach budgeting. It’s not just about crunching numbers—it’s about making the process personal, creative, and even fun. Whether you’re tracking expenses, planning your budget, saving for a goal, or tackling debt, there’s a layout that can work for you.

The beauty of these layouts is how adaptable they are to your needs. You can experiment, tweak, and design them in a way that keeps you motivated and focused on your financial goals. It’s all about finding what inspires you to stay consistent and take charge of your money.

So grab your favorite pens, pick a layout, and start building a system that works for you. Small steps can lead to big financial wins, and with a little creativity, budgeting doesn’t have to feel like a chore.

Frequently Asked Questions

What is a finance bullet journal, and how can it help with budgeting?

A finance bullet journal is a customizable tool that helps individuals track their income, expenses, savings, and debt. It turns budgeting into a creative and enjoyable activity by using layouts that visually organize financial information. These journals help you understand spending habits, set savings goals, and create effective budget plans.

What are the best layouts for tracking expenses in a bullet journal?

The article highlights two effective layouts: the Simple Monthly Expense Tracker, which uses a table to record transactions, and the Color-Coded Expense Tracker, which categorizes expenses by color for better visualization. Both are efficient and easy to use.

How can I track variable income in my bullet journal?

To track variable income, use the Variable Income Tracker layout. It allows you to compare projected income against actual earnings each month, helping you manage financial expectations and adjust your budget accordingly.

What is a zero-based budget layout, and how does it work?

A zero-based budget layout ensures every dollar has a purpose. Income minus expenses equals zero, with funds allocated to savings, discretionary spending, or debt payoff. Bold headers and dividers make this layout visually clear and functional.

How can I make savings tracking more fun and motivating?

Use creative savings tracker layouts like a Savings Goal Tracker with a thermometer or bar chart design, and an Emergency Fund Tracker featuring roadmaps, raindrops, or umbrellas to visualize progress toward your goals.

What is the difference between the Debt Snowball and Debt Avalanche Trackers?

The Debt Snowball Tracker focuses on paying off smaller debts first for quick wins, while the Debt Avalanche Tracker prioritizes high-interest debts to save money over time. Both layouts are visually engaging and help motivate debt repayment.

Are finance bullet journals suitable for beginners?

Absolutely! Finance bullet journals are highly customizable, allowing beginners to start with simple layouts like expense trackers or budget spreads. Over time, they can explore more advanced layouts as they grow comfortable with their budgeting process.

Can finance bullet journals help with saving for specific goals?

Yes, saving for specific goals becomes easier with visual layouts like the Savings Goal Tracker. These designs help you track progress toward milestones, keeping you motivated and focused on achieving financial objectives.

How do income and expense trackers work together in a bullet journal?

Income and expense trackers provide a complete picture of your finances. While expense trackers help monitor outgoing funds, income trackers record all your earnings. Together, they ensure you stay on top of your budget and manage surplus effectively.

Why is creativity important in finance bullet journals?

Creativity makes budgeting less intimidating and more engaging. With personalized designs, colors, and layouts, finance bullet journals transform routine financial tracking into a fun activity, encouraging consistency and better financial habits over time.