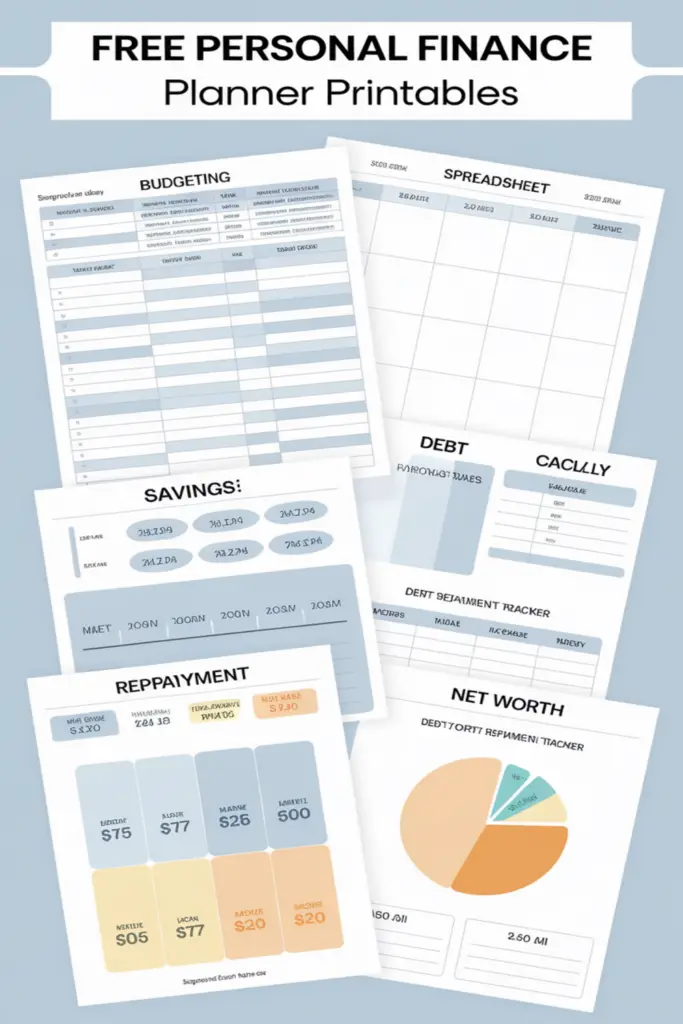

I’ve always been on the hunt for the perfect tools to manage my money, and I’ve found that free personal finance planner printables are a game-changer. They’re not only budget-friendly but also incredibly customizable to fit my unique financial goals.

Whether you’re trying to save for a big trip or just want to keep your daily spending in check, these printables can help you stay on track. In this article, I’ll share my top picks for the best free personal finance planner printables that you can start using today.

1. Monthly Budget Planner

Printable Overview

I’ve found a monthly budget planner that’s perfect for tracking your finances. It’s a clean, straightforward layout that helps you see where your money goes each month.

Key Features

This planner includes sections for income, expenses, and savings goals. You’ll also find a space to note any irregular expenses, which is super helpful for planning ahead.

How to Use Effectively

I use this planner by filling it out at the start of each month. I list all my expected income and expenses, then adjust as needed throughout the month. It’s key to review it weekly to stay on track with your financial goals.

2. Expense Tracker

Moving on to keeping my spending in check, let’s dive into the expense tracker.

Printable Overview

I’ve found an awesome expense tracker printable that’s perfect for jotting down every penny spent. It’s got a simple design that makes it easy to use daily.

Key Features

This tracker lets me categorize my expenses into things like groceries, utilities, and entertainment. There’s also a section for daily totals which helps me see where my money’s going at a glance. Plus, it’s got space for notes, so I can add any important details about my purchases.

Tips for Tracking Expenses

I make sure to fill out this tracker every day to keep my spending habits in check. It’s helpful to set a weekly review where I go over my expenses and adjust my budget if needed. And, I always keep this tracker in a spot where I’ll see it daily to remind myself to record everything.

3. Savings Goal Worksheet

Printable Overview

I’ve found this Savings Goal Worksheet to be a game-changer for setting and tracking my savings targets. It’s a straightforward printable that helps me visualize my financial goals and keep my motivation high.

Key Features

- Clear Goal Setting: It allows me to define specific savings goals, whether it’s for a new laptop or a dream vacation.

- Progress Tracking: I can easily monitor my progress with a visual bar that fills up as I save, which keeps me engaged.

- Motivational Quotes: The worksheet includes inspiring quotes that encourage me to stick to my savings plan.

- Flexible Timeframes: I can set short-term, medium-term, or long-term goals, making it adaptable to any saving need.

Strategies for Achieving Savings Goals

- Break Down Goals: I break my big savings goals into smaller, manageable chunks. This makes the process less daunting and more achievable.

- Automate Savings: Setting up automatic transfers to my savings account ensures I’m consistently saving without having to think about it.

- Review Regularly: I review my Savings Goal Worksheet weekly to adjust my strategy and stay on track, ensuring I’m always moving forward.

4. Debt Reduction Plan

I’ve found that tackling debt can feel overwhelming, but a solid plan can make all the difference.

Printable Overview

I stumbled upon this debt reduction plan printable that’s a total game-changer. It’s designed to help you map out your debts and create a strategy to pay them off efficiently.

Key Features

- Debt List: I can list all my debts in one place, making it easy to see the big picture.

- Payment Schedule: It includes a section where I set up a payment schedule, helping me stay on track.

- Snowball/Avalanche Method: I choose between the snowball or avalanche method to prioritize my debt payments.

- Progress Tracker: There’s a visual tracker that shows my progress as I pay down my debts, which keeps me motivated.

Steps to Reduce Debt

- List All Debts: I start by listing every debt I have, including the creditor, balance, and interest rate.

- Choose a Strategy: I decide if I’ll use the snowball method, paying off the smallest debts first, or the avalanche method, focusing on the highest interest rates.

- Set Up Payments: I set up my payment schedule, ensuring I make at least the minimum payments on all debts while allocating extra funds to my chosen strategy.

- Track and Adjust: I regularly update my progress on the printable and adjust my plan if my financial situation changes.

5. Income and Expense Statement

Printable Overview

I’ve found a fantastic income and expense statement printable that’s a must-have in your financial toolkit. It provides a clear snapshot of your monthly financial health by detailing where your money comes from and where it goes.

Key Features

This printable includes sections for listing all sources of income, such as salaries, freelance work, and side gigs. On the expense side, you can categorize your spending into essentials like rent, utilities, groceries, and discretionary items like dining out and entertainment. It also features a summary section that calculates your net income, helping you see if you’re living within your means.

6. Bill Payment Calendar

Printable Overview

I’ve found this Bill Payment Calendar to be a lifesaver for keeping my bills in check. It’s a simple yet effective tool that helps me avoid late payments and manage my finances smoothly.

Key Features

- Monthly Layout: I can see all my bills for the month at a glance, which makes planning super easy.

- Color-Coding: I use different colors for different types of bills, like utilities in blue and credit cards in red, to quickly identify them.

- Reminder Section: There’s a space to jot down reminders for upcoming due dates, so I never miss a payment.

- Notes Area: I find the notes section handy for adding any extra info or changes in bill amounts.

Organizing Bill Payments

I start by listing all my bills at the beginning of the month on the calendar. Then, I mark the due dates and color-code them for clarity. I set reminders a few days before each due date to ensure I pay on time. This system has really helped me stay organized and on top of my finances.

7. Net Worth Calculator

Printable Overview

I’ve found a fantastic net worth calculator that’s perfect for anyone looking to get a clear picture of their financial standing. This printable helps you tally up your assets and liabilities to see where you stand financially.

Key Features

The net worth calculator includes sections for listing all your assets, like savings accounts, investments, and property. It also has spaces for your liabilities, such as loans and credit card debt. What I love is how it calculates your net worth automatically, making it super easy to track changes over time.

Understanding Your Financial Health

Using this net worth calculator has been a game-changer for me. It’s not just about knowing your numbers; it’s about understanding how your financial decisions impact your overall wealth. By regularly updating this printable, I can see trends and make informed choices to improve my financial health.

8. Emergency Fund Planner

Printable Overview

I’ve found an Emergency Fund Planner that’s a game-changer for those unexpected expenses. It’s a simple yet effective tool designed to help you build and track your emergency savings.

Key Features

- Goal Setting: I set my target amount right at the top, which keeps me motivated.

- Monthly Contributions: I track how much I add each month, making it easy to see my progress.

- Expense Tracking: If I dip into the fund, I note it here to understand my spending patterns.

- Visual Progress Bar: There’s a bar that fills up as I save, which gives me a visual boost every time I look at it.

Building Your Emergency Fund

I start by determining how much I need for my emergency fund, usually aiming for 3-6 months of living expenses. Then, I set a realistic monthly savings goal based on my budget. I automate my savings to ensure I’m consistently adding to the fund without thinking about it. Whenever I use the fund, I make sure to replenish it as soon as possible, keeping my financial safety net intact.

9. Retirement Savings Tracker

Printable Overview

I’ve found a fantastic Retirement Savings Tracker printable that’s perfect for anyone looking to secure their future. It’s designed to help you monitor your progress toward retirement goals in a straightforward way.

Key Features

- Goal Setting: I can set specific retirement savings targets with this tracker, making my long-term financial planning clear and actionable.

- Contribution Tracking: It lets me record my monthly contributions, so I always know how much I’m putting away for retirement.

- Investment Growth: The tracker includes sections for noting down investment growth, helping me see how my savings are performing over time.

- Visual Progress Bar: There’s a visual progress bar that keeps me motivated by showing how close I am to reaching my retirement savings goal.

Planning for a Secure Retirement

Using this Retirement Savings Tracker, I’ve been able to plan more effectively for my future. It encourages regular contributions and helps me understand the impact of compound interest on my savings. By keeping track of my investments and adjusting my strategy as needed, I’m confident I’m on the right path to a secure retirement.

Conclusion

I hope you find these free personal finance planner printables as helpful as I do. They’ve truly transformed the way I manage my money. Give them a try and see how they can help you reach your financial goals!

Frequently Asked Questions

What are personal finance planner printables?

Personal finance planner printables are customizable, budget-friendly tools designed to help manage various aspects of finances, such as budgeting, tracking expenses, setting savings goals, and planning for debt reduction and retirement.

How can a monthly budget planner help with financial management?

A monthly budget planner helps by providing a structured layout to track income, expenses, and savings goals. It’s useful for planning at the beginning of the month and reviewing weekly to ensure alignment with financial objectives.

What is the purpose of an expense tracker printable?

An expense tracker printable is designed to monitor daily spending, categorize expenses, and track daily totals. Using it regularly helps maintain awareness of spending patterns and encourages more mindful financial decisions.

How does a Savings Goal Worksheet assist in achieving financial goals?

A Savings Goal Worksheet visualizes financial goals by allowing clear goal setting, progress tracking, and adding motivational quotes. It helps break down larger goals into manageable steps and supports strategies like automated savings.

What is the benefit of using a Debt Reduction Plan printable?

A Debt Reduction Plan printable helps map out debts and strategize their payoff using methods like the snowball or avalanche approach. It includes a visual progress tracker to keep users motivated and focused on becoming debt-free.

How does an Income and Expense Statement printable aid in financial health?

An Income and Expense Statement printable provides a monthly snapshot of financial health by detailing income sources and expenses. It includes a summary section to calculate net income, helping users understand their financial standing.

What features does a Bill Payment Calendar offer?

A Bill Payment Calendar features a monthly layout for planning, color-coding for different bill types, reminders for due dates, and a notes area. It helps manage bills effectively and avoid late payments by organizing and tracking due dates.

How can a Net Worth Calculator printable improve financial decisions?

A Net Worth Calculator printable assesses financial standing by tallying assets and liabilities, automatically calculating net worth. Regular updates help users track changes over time and make informed choices to enhance their overall wealth.

What is the purpose of an Emergency Fund Planner?

An Emergency Fund Planner helps build and track emergency savings with features like goal setting, monthly contributions, expense tracking, and a visual progress bar. It supports establishing a safety net of 3-6 months’ living expenses.

How does a Retirement Savings Tracker assist in planning for retirement?

A Retirement Savings Tracker helps monitor progress toward retirement goals by tracking contributions, investment growth, and providing a visual progress bar. It encourages regular savings and understanding the impact of compound interest on retirement funds.