Managing money can feel overwhelming, but it doesn’t have to be. When I first heard about the 50/30/20 budget rule, it completely changed how I looked at my finances. It’s simple, practical, and works for just about anyone—whether you’re saving for a big goal or just trying to stay on top of your expenses.

Understanding The 50/30/20 Budget Rule

I’ve always believed budgeting doesn’t have to be complicated, and the 50/30/20 rule proves just that. It’s a simple way to organize your finances and build financial discipline without feeling overwhelmed.

What Is the 50/30/20 Budget Rule?

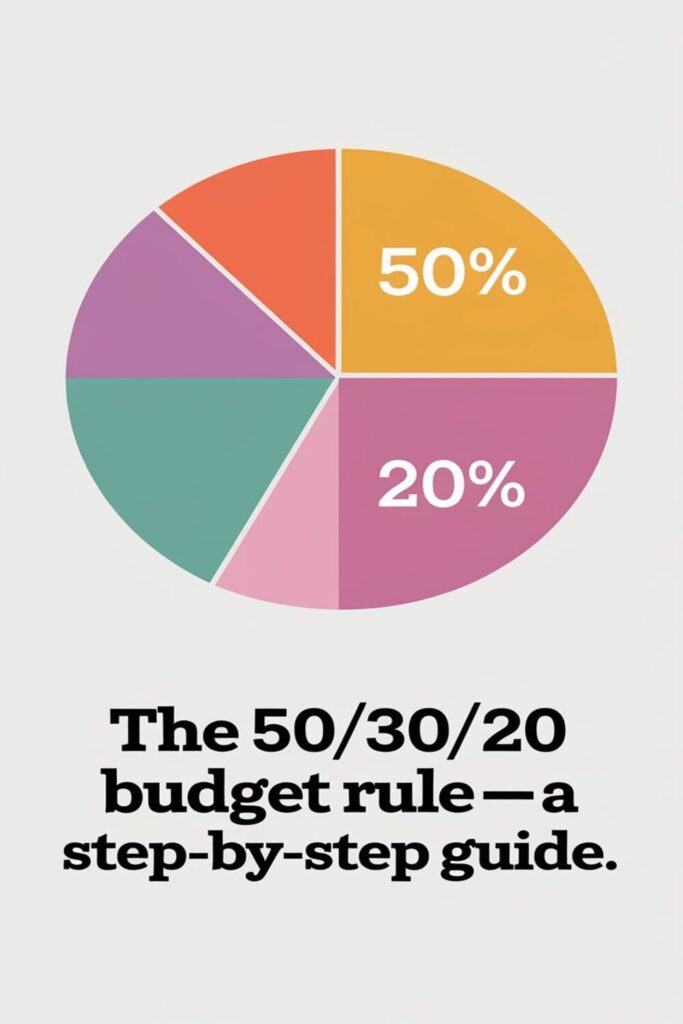

The 50/30/20 budget rule splits your after-tax income into three main categories—needs, wants, and savings or debt payments. You allocate 50% of your income to necessities like rent, groceries, utilities, and insurance. 30% is for things you want, such as dining out, hobbies, or entertainment. The remaining 20% goes toward financial goals like saving for emergencies, retirement, or paying down debt. This framework makes it easier to track spending and prioritize financial wellbeing.

Origins and Purpose of the Rule

The 50/30/20 rule was popularized by Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi, in their book All Your Worth: The Ultimate Lifetime Money Plan. Their goal was to create a straightforward method anyone could use for budgeting. It emphasizes a balance between enjoying life and achieving financial stability, which makes it particularly appealing to people juggling multiple goals.

Why This Budgeting Method Works

This method works because it’s flexible and realistic. By dividing money into clear categories, it helps you avoid overspending in one area while ignoring another. For example, I’ve found the 30% “wants” category keeps me from feeling deprived, making it easier to stick to my budget. At the same time, it encourages saving consistently, which builds long-term financial security. The simplicity of the rule makes it adaptable for any income level, so it’s approachable for everyone.

Breaking Down the Rule: The Categories

The 50/30/20 budget rule divides your after-tax income into three simple categories. Here’s how I break it down to keep my spending in check and still enjoy life.

Allocating 50% for Needs

I use half of my income for essentials—the expenses I can’t live without. These include housing, utilities, groceries, insurance, transportation, and minimum debt payments. For example, my rent and monthly grocery bill fall under this category. Needs are non-negotiable; they keep the lights on and ensure I meet my basic living standards without compromise.

Reserving 30% for Wants

This category is all about enjoying life guilt-free. I allocate 30% of my income to things I enjoy but could technically live without, like dining out, streaming subscriptions, hobbies, and vacations. For instance, that weekend road trip or the latest gadget I’ve been eyeing fits perfectly here. It’s my space to splurge within reason, keeping me motivated while staying financially balanced.

Saving 20% for Financial Goals

The final chunk ensures I’m working toward a stronger financial future. I dedicate 20% to savings, investments, or paying down extra debt. For example, I contribute to my emergency fund, retirement account, or tackle credit card balances faster. This category ensures I’m building wealth and staying prepared for life’s surprises.

Setting Up Your 50/30/20 Budget

Getting started with the 50/30/20 rule is simpler than you might think. By following these steps, you can create a budget that fits your lifestyle and financial goals.

Step 1: Calculate Your After-Tax Income

Start by figuring out how much money you bring home after taxes. This includes your paycheck, side gigs, rental income, or any other earnings. If you’re salaried, check your direct deposits or pay stubs for a clear number. For freelancers or business owners, subtract taxes from your gross revenue to get the after-tax figure. This is the base amount you’ll use to divide your budget into the 50/30/20 categories.

Step 2: Identify Your Needs, Wants, and Savings

Next, divide your after-tax income into three buckets: needs, wants, and savings. Needs include essentials like rent, utilities, groceries, insurance, and minimum debt payments. Wants cover discretionary expenses like takeout, streaming services, or fun activities. Finally, allocate 20% to savings, investments, or paying off extra debt. I find it helpful to review recent bank or credit card statements to separate fixed, variable, and optional expenses.

Step 3: Use Budgeting Tools or Apps

Leverage technology to make budgeting easier. Apps like Mint, YNAB, or EveryDollar can track your spending, categorize expenses, and notify you if you’re approaching limits in any section. Many tools let you visualize trends or set custom alerts. Personally, I find inputting my budget into an app keeps me accountable—it’s like having a financial coach in my pocket. Even a simple spreadsheet works if apps aren’t your thing.

Tips for Staying on Track

Sticking to the 50/30/20 budget rule takes consistency and a little flexibility. Here are a few tips I’ve learned to help stay on course:

Adjusting the Budget as Necessary

Life happens, and sometimes your budget needs a tweak. If my income changes or I face unexpected expenses like medical bills, I revisit my budget to make adjustments. For example, I might temporarily reduce spending on wants to cover an urgent need. Being realistic about fluctuating expenses helps me stick with the plan long term.

Avoiding Common Budgeting Mistakes

Overspending on wants is a trap I’ve fallen into before. I remind myself to keep those costs within 30% by distinguishing between true wants and needs. Another mistake I’ve avoided is neglecting my savings. Even if money’s tight, I always try to save something—even $10 a week matters. Staying mindful of these missteps can save a lot of frustration.

Tracking Your Spending Regularly

I’ve learned that tracking every dollar makes a big difference. Using apps like Mint or YNAB, I check my spending weekly to ensure it’s aligning with my budget. If I notice I’m overspending in one category, I make adjustments to fix it early. Regular tracking keeps me accountable and reduces surprises at the end of the month.

Benefits of the 50/30/20 Budget Rule

This budgeting method isn’t just practical—it’s a game-changer for anyone looking to take control of their finances. Here’s why I think it works so well:

Simplicity and Flexibility

The 50/30/20 rule is easy to understand, and that’s its biggest strength. You just split your income into three straightforward categories: needs, wants, and savings. There’s no overthinking or combing through complex spreadsheets. Plus, it’s flexible enough to adjust to your lifestyle. If you’re dealing with a temporary expense spike, like moving or medical bills, you can tweak your allocations without derailing your entire plan. It’s adaptable for everyone, from college students managing part-time jobs to families planning for long-term goals.

Encouraging Savings Discipline

By dedicating 20% of your income to savings or debt repayment, this rule builds a habit of prioritizing your future. For me, it was the push I needed to stop dipping into my savings for non-urgent stuff. It’s also great for goal-oriented saving—whether it’s for retirement, a dream vacation, or paying off loans faster. Knowing 20% of my income automatically goes toward something meaningful has honestly made saving feel less like a chore and more like progress.

Promoting Financial Awareness

This budgeting method makes you more mindful of where your money is going. When I started using it, I quickly realized how much I was spending on unnecessary things, like daily coffee runs or last-minute shopping sprees. It encourages you to stop, look at your finances, and question if your spending aligns with what you actually value. Over time, this awareness helps you become smarter about your financial decisions, reducing wasteful habits and focusing on what truly matters.

Conclusion

The 50/30/20 budget rule has been a game-changer for me when it comes to managing my finances. Its simplicity and flexibility make it easy to stick with, no matter what your financial situation looks like. By breaking down income into clear categories, it creates a sense of balance between enjoying life and planning for the future.

Whether you’re saving for a big goal or just trying to get a better handle on your spending, this method offers a practical framework to stay on track. It’s not about perfection—it’s about progress and finding a system that works for you.

Frequently Asked Questions

What is the 50/30/20 budget rule?

The 50/30/20 budget rule is a simple financial guideline that divides your after-tax income into three categories: 50% for needs (essential expenses like rent and groceries), 30% for wants (discretionary spending like entertainment), and 20% for savings or debt repayment. It is designed to simplify financial management and promote a healthy balance between spending and saving.

Who created the 50/30/20 budgeting rule?

The 50/30/20 rule was popularized by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book “All Your Worth: The Ultimate Lifetime Money Plan.” It aims to help individuals better manage their finances by finding a balance between necessities, enjoyment, and long-term financial goals.

How do I calculate my after-tax income for the 50/30/20 rule?

To calculate your after-tax income, take your gross income (your earnings before taxes) and subtract taxes, such as federal, state, and Social Security taxes. For salaried workers, this is usually the amount deposited into your account after taxes are withheld. If you’re unsure, check your pay stub or tax documents.

What expenses fall under the “needs” category in the 50/30/20 rule?

The “needs” category, which makes up 50% of your income, includes essential and non-negotiable expenses. Examples are rent or mortgage payments, utilities, groceries, insurance, transportation, and minimum debt obligations. These are the costs you must cover to maintain a basic standard of living.

What counts as “wants” in the 50/30/20 budget?

The “wants” category, which accounts for 30% of your income, covers discretionary spending. This includes dining out, entertainment, hobbies, vacations, subscriptions, and other non-essential purchases. These expenditures add enjoyment to your life but are not necessary for basic living.

How should the savings portion of the 50/30/20 rule be used?

The 20% allocated for savings should go toward building an emergency fund, investing in retirement accounts, paying down debt, or saving for long-term goals like buying a home. This portion is crucial for financial security and achieving future financial milestones.

Can the 50/30/20 rule work for any income level?

Yes, the 50/30/20 rule is flexible and adaptable, making it suitable for people across all income levels. However, individuals with lower incomes may need to reallocate percentages to focus more on needs and savings. Adjustments can be made to fit your unique financial situation.

What tools can I use to manage a 50/30/20 budget?

Several budgeting tools and apps can help you track expenses and stick to the 50/30/20 rule. Popular options include Mint, You Need a Budget (YNAB), and EveryDollar. These tools categorize your spending, making it easier to stay aligned with your budgeting goals.

How often should I review my 50/30/20 budget?

It’s recommended to review your budget at least monthly or whenever your financial situation changes, such as receiving a raise or experiencing unexpected expenses. Regularly monitoring your budget ensures you stay on track and make necessary adjustments to meet your goals.

What are the main benefits of the 50/30/20 budgeting method?

The 50/30/20 rule is easy to follow, adaptable to different lifestyles, and promotes financial awareness. It simplifies money management by dividing income into clear categories, encourages discipline in saving and debt repayment, and helps avoid unnecessary overspending, fostering long-term financial stability.