Career In Private Equity – In the present-day scenario, where the markets are dynamic and evolving constantly, it is only a matter of time before a new kid draws the spotlight of attention from the existing players by its entry. ‘Private equity, the jargon has created a lot of buzz over the years, making it the ‘New kid’ in the investment town. It sure is giving a tough run to the investment banking sector and other investment alternatives. The usage of this term has been in heavy rotation in recent years. WHY, you ask? Instead, what you should really be asking is ‘’WHY NOT?’’, the introduction of private equity firms has been nothing but a win-win for both the players across the table. In fact, for all the players on the table, so to speak – The investors, the asset management companies, target companies, the stakeholders in the process, and of course, the private equity themselves, and the people indirectly or directly benefitting from them such as through exchange-traded funds or mutual funds. The private equity firm earns better than public equity markets, and those invested in private equity firms earn reasonably well than an average investor with other investing alternatives. Now, you can fairly imagine what private equities with deep pockets would earn like!

It is undoubtedly the most sought-after stream to get into, and it is indeed receiving the hype it deserves through all the success it is gaining. Before getting thoroughly and properly briefed about what private equities really are, in the forthcoming sections, let us have ourselves address the same in layman’s terms for better understanding. So basically, private equity firms are attractive investment vehicles that utilize their own funds or investment chipped in from investors and search for good investment opportunities, it could be in real estate, venture capital, leveraged buyouts in a fund of funds, etc. this is done through auctions against the other competing bidders, after buying whatever they were looking for, the PE remains invested for long-term and makes big bucks through a profitable exit strategy which could be through – Initial public offer, resale, or other alternative options.

Let’s understand this better.

Now, What Is Private Equity?

‘Private equity,’ ‘Private’ because it acquires private firms or delisted public companies, and ‘Equity’ because it focuses on equity investments. The concept of private equity has grown so much into prominence that investment banking companies such as ‘Goldman Sachs’ and ‘Morgan Stanley’ also have private equity arms.

PE firms are mostly not listed publicly. In few cases, some private equities, such as business development companies (BDCs), offer publicly traded stock giving the average investor to own a slice of the private equity pie. For example, Blackstone Inc. trades its shares publicly on NYSE. So, private equities are investment companies that have funds of their own such as from the capital, management fees, initial investments, and the investments from the outside investors such as pension funds, high net worth individuals (HNIs), qualified institutional buyers (QIBs), venture capitalists (VCs), Investment banks and other investors. Private equity firms generally specialize in a niche, which could be industry-wise, stage of maturity of the company wise (such as in starting stage in case of start-ups or later stages), seed investment-wise, etc. Now, these funds that the PE owns are applied prudently and with careful research and analysis to acquire investments that best fit the company’s portfolio.

These investments can be in the form of distressed funding, leveraged buyout, real estate, fund of funds and, venture capital. These are purchased via auctions where they face huge competition from other investors such as the mergers and acquisitions companies. Once the target firm is acquired, though they are invested in them for the long term, they are not involved daily. Their degree of involvement in the target firm is directly proportional to their stake in that target firm. That is – the higher the degree of stake, the more the involvement and vice-versa. Unlike the ‘Hedge funds,’ who remain invested for short-term on an average of 2-3 months and exit by selling the shares at a profitable margin at the right opportunity. Moreover, the hedge funds are unlikely to invest in non-public companies.

Whereas the private equity firms invest in non-public companies, they also invest in public companies in certain cases and de-list them later during the investment period. Unlike hedge funds, private equity firms remain invested for the long term for the average period of 5-10 years. The minimum period is 2+ years depending on the time, the situation, the company acquired, and the liquidity requirements. The PE company acquires more than 50% of shares of the target company (the company that is being acquired.), the first step after acquiring the stake is de-listing the target company – because by taking public companies private, the PE firms remove the constant public scrutiny of quarterly earnings, reporting and other compliances which then allows them and the acquired firm’s management to take a long-term approach in bettering the fortune of the company.

The next step is ‘Change of management’ was required according to the suitability there are changes in the composition of management of the company, the PE, and the management of the company collectively work towards increasing the EBITDA (Earnings before interest, taxes, depreciation, and amortization) during the investment period. And in most cases, the management’s compensation is tied with the firm’s performance, incentivizing the management to track the company’s financials exponentially.

The PE also makes an effort to progressively improve the financial performance of the acquired company through rendering various services such as advisory, formulating, implementing controlling and monitoring strategies, consulting, operations, and financial management. By building the company and its financials internally and scaling up its market value, the PE with a good opportunity and profitable exit strategy sell the stake in the investment by resale/IPO/ alternate options.

The steps mentioned above might not be necessarily executed in the given order as it is ‘Relative’ to companies and not an ‘Absolute’ protocol.

Structure And Composition Of A Private Equity Firm

A private equity firm could be of two types depending on the business requirement. It could be in the form of – 1) ‘Limited partnership’ or 2) ‘Closed-end funds.’ Limited partnerships are usually practiced in the United States, and Closed-end funds form of PEs are generally practiced in the European countries.

Limited Partnership

Under a limited partnership, there are two kinds of partners – the ‘General partners’ and the ‘Limited partners.’ General partners are those with full liability, and the limited partners have limited liability on their part. The functions of general partners include management of funds, post-investment advisory, target company portfolio selection. They also charge the partners a management fee and manage the portfolio and investment in other companies.

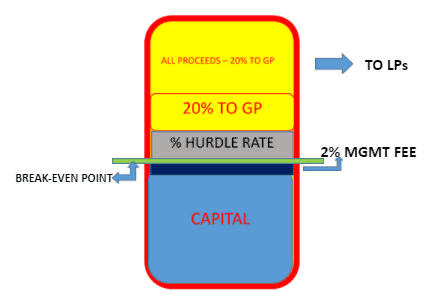

The compensation structure in the limited partnership is that of ‘2% -20%,’ but the norm can vary according to the company’s framework. ‘2% – 20%’ scheme is where the 2% denotes the management fees collected from the partners, and 20% denotes the share of profits to general partners. The limited partners receive from the residual proceeds that are left after what is given to general partners. That is, limited partners receive ‘All proceeds – 20% to GP’. The general partners have 1st preference over the limited partners. This could sometimes be beneficial for limited partners and sometimes not, depending on the company’s degree of profits. Therefore, the general partners face less risk than the limited partners in the case of returns.

THIS IS HOW A 2-20% COMPENSATION STRUCTURE LOOKS LIKE:

NOTE – HURDLE RATE ONLY COMES TO THE PICTURE WHEN THE SAME IS AGREED UPON DURING THE PARTNERSHIP AGREEMENT. IT DEFINES A CERTAIN MINIMUM RATE OF RETURN THAT NEEDS TO BE ACHIEVED BEFORE ACCRUING CARRIED INTEREST TO GENERAL PARTNERS.

Close End Funds

The closed-end funds have the same compensation scheme as the limited partnership structure. Here, in this case, there is a newly created entity in which the investors such as high net-worth individuals, qualified institutional buyers, venture capitalists, and other sorts of investors invest, and an ‘asset management company (AMC) is called to sign a management contract to manage the newly established PE firm. The first phase that this newly established company undergoes is the formation phase, which lasts up to 2 months to 3 years, and then comes the investment phase, which lasts up to 5 years. The investment phase is where predominantly most of the transitional activities get done, such as identifying target companies, optimizing the company’s portfolio, change of management, etc. Next is the ‘Divestiture’ which could last up to 5 years or so. This is where the market volatility is taken into consideration. The general state of the economy is studied. After all the research and analysis are done, the hunt for finding the right buyer begins. And the fund proceeds from the sale are distributed among the asset management company, investors, stakeholders, general partners, and limited partners in case of a limited partnership.

Career In Private Equity Firms

Private equity is indeed an enticing career to take up. Three vital factors help back up that statement. These factors act as a barometer to measure the viability of a certain career – 1) Payscale, 2) knowledge and experience derived from the job, and 3) investment of time (work hours). And to your delight, private equity firms sufficiently satisfy all three criteria, making it a fascinating and very lucrative career. They don’t need to work as long as those at investment banking companies. The work hours are less as compared to the IB and other finance industries in private equities. The work hours reduce as you go up the hierarchy. Even the associates are paid high amounts at their age! And the bonuses have the scope to scale up to 150% of base salary easily.

The two key compensation trends in the private equity industry are:

- Salaries and bonuses for private equity are growing and at a faster rate than in the overall market.

- Carried interest is increasingly being distributed downwards and upwards in the hierarchy in the firm.

The pay in private equity firms drastically increases from one year to the next. For instance, the average increase in 2019 in an analyst’s pay was – $1,00,000 in the first year to $1,30,000 in the second year to $1,60,000 in the third. Which are, mind you, 10-20% higher than an investment banking analyst’s average pay. In 2019, the managing partner’s pay ranged from $1.1 million – $ 3.7 million for companies with greater than $20 billion in AUM (Asset under management). And, for directors and partners of companies with AUM greater than $5 billion, it ranged from $5,96,000 – $2.2 million, and the mean cash compensation for partners was hovering around $5,92,000. And likewise for associates it ranged from $1,70,000 – $3,15,000.

Factors Determining The CTC In Private Equity Firms

- THE FIRM SIZE – Apparently, the firm size plays a crucial role in determining the CTC of a candidate. Now, if you are at the top megafund, you can expect to get paid big. Needless to state, the prominence and size of the firm also influence the pay up to some extent. The big players in the private equity industry include ‘The Carlyle Group Inc.,’ ‘KKR & co. Inc’, ‘The Blackstone Group Inc.,’ ‘TPG Capital’ so on and so forth make quadruple times more than any other, and eventually, the staff reaps the benefits of its goodwill. ‘Apollo Global Inc.,’ ‘Brookfield Asset Management’ and ‘The Blackstone Group Inc.’ is the highest paying private equity firm. Generally, it is not a market standard to pay carry (the portion of profits in the fund) to associates. But big firms with assets under management of $1.5 billion pay up to 18% carry to their associates.

- EXPERIENCE AND QUALIFICATION – Generally, it is tough for an undergrad or graduate/ fresher holding just an associate’s or bachelor’s degree to get into a private equity firm. The private equity firms are generally recruiting those with master’s degrees or postgraduate degrees with experience or at the least a combination of bachelor’s degrees + 3 years of experience in the finance industry. The asking price increases with experience. In most cases, it is observed that the private equity firms generally recruit an ex-investment banker or ex-consultants or those running start-ups as they are no strangers to the finance industry and as they have requisite working knowledge and experience in skillsets such as financial modeling, financial valuation, investment judgment, etc. More the experience, the higher the position on the hierarchy – A person with 2-4 years of relevant working experience could be promoted to the position of an associate, similarly with 5-8 years of experience, you are promoted to the role of vice-president, 9-15 years could fetch you the position of a director or a principal, and with 15+ years of experience you could see yourself being promoted to the position of a partner!

- ASSET UNDER MANAGEMENT – The AUM of the company in 90% cases is directly proportional to the pay. Asset under the management of the private equity firm gives us an idea of the magnitude of the firm, its assets, and its size—the greater the AUM, the bigger the paycheck, and vice versa.

- COUNTRY LOCATION – To some extent, the country’s location also plays a pivotal role in differential pay structure. For instance, normally, only partners and positions up in the hierarchy are entitled to carry interest (a share in the profit) according to industrial norms. But, in 2019, 30% of the North American firms and 37.5% of European firms allocated carry to non-partner admin or support staff. And the workers of PE firms in APAC and middle eastern countries were deprived of the same. The analyst in the US earns $86,000, whereas the same analyst would earn just about $57000 in Asia. Similarly, the pay of an associate is way higher ($1,07,000) in the US than what an associate would earn in a European country ($82,000). But, on the contrary, the partner in a European country earns much higher than what a partner would earn in the states. The same is the case with a Sr. associate and director/principal being paid the highest in the US and lowest in Asian countries.

- POSITION IN THE HIERARCHY – Position in the hierarchy is another important factor that has a huge impact undoubtedly for obvious reasons on the paycheck of an individual. The upper side of the hierarchy tends to have bigger paychecks than those at the bottom. The private equity firms do not have a complex hierarchy or a massive number of members or employees under it, so the ones under it make much more than the others as the profits are divisible by a smaller group of numbers. Hence obscene returns are bound to happen. The hierarchy in PE firms, starting with the junior level, analysts, then comes to the associates and the Sr. associates. At the mid-senior level, you have vice president, president/director, and then at the very top of the hierarchy, managing director or partner.

- THE ANALYSTS – An analyst works on an average of 65 hours a week. He is unlikely to receive a carried interest. He is entitled to receive an average pay, including that of bonus and salary around $1,00,000 -$1,50,000. An analyst’s duties include reporting to the associate or immediate senior and analyzing the company’s investments and portfolio, setting up conference calls, assisting associates, etc. They usually get promoted after 2-3 years.

- THE ASSOCIATES – An associate works on an average for 60 hours weekly, even he is unlikely to receive the carry, and his average pay range exists between $1,50,000 – $3,00,000. The duties of an associate include research, due diligence, financial modeling, report writing, reviewing and summarizing confidentiality information memorandum, etc. Their promotion time range is equal to that of analysts, that is, 2-3 years.

- THE SR. ASSOCIATES – A senior associate is estimated to work for about 65 hours weekly. He is entitled to receive a small portion in the carry and is also entitled to a pay range of $2,50,000 – $4,00,000. The duties of a Sr. associate include guiding his subordinates, reporting to the vice-president and president as the case may be, portfolio management etc. They also have a similar duration of promotion time, that is, 2-3 years.

- VICE-PRESIDENTS – A Vice-president who comes under the mid-senior cap works weekly roughly around 55 hours and is entitled to grow a portion of carrying and a pay range between $3,50,000 – $5,00,000. His duties include supervising associates, assist MD and partner, negotiating deals, establishing and maintaining relationships with investment bankers, consultants, and financial professionals who can be a source of leads for investment opportunities. Their duration of promotion time is 3-4 years.

- DIRECTORS/PRESIDENTS/PRINCIPALS – They have quite similar duties to vice presidents and greater leadership responsibilities. They are entitled to a large portion of carrying. And with a promotion time of 3-4 years. They are entitled to a pay range of $5,00,000 – $8,00,000 on an average—the estimation of weekly working hours of principal hover around 50 hours.

- MANAGING DIRECTOR/ PARTNERS – They are the lifeblood of PE firms. Their weekly estimation of working hours is around 40 hours. This is the highest one can reach in a private equity firm; hence promotions are not applicable after this stage. They are entitled to the biggest portion of carrying (upward of 3 million dollars) and are entitled to a staggering pay range of $7,00,000 – $2 million. Their duties are ultimate and have a ripple effect and determine the direction of the firm. Their job includes – making final decisions, structuring investment deals, actively solicit investors, etc.

THE BOTTOM LINE

The private equity industry is worth betting on from the standpoint of every position on the hierarchy. As not only is the career highly lucrative, but the learning curve’s growth is much faster. With on-the-job training and priceless experience at the PE firm, the individual’s skillsets are honed, and he will have a myriad of options open to him in the finance industry as someone who’s had his experience come from a PE industry. Hence, if you find an opportunity, join that in a heartbeat!

Also read How to Become a Private Equity Associate in 2021?